What to know about IRS Section 179 and vehicle deductions

Vehicle purchases can be a big expense for a business. But whether you’re a contractor or a caterer, a landscaper or a locksmith, your operation risks being stalled, or even coming to a complete standstill, if you don’t have the necessary wheels.

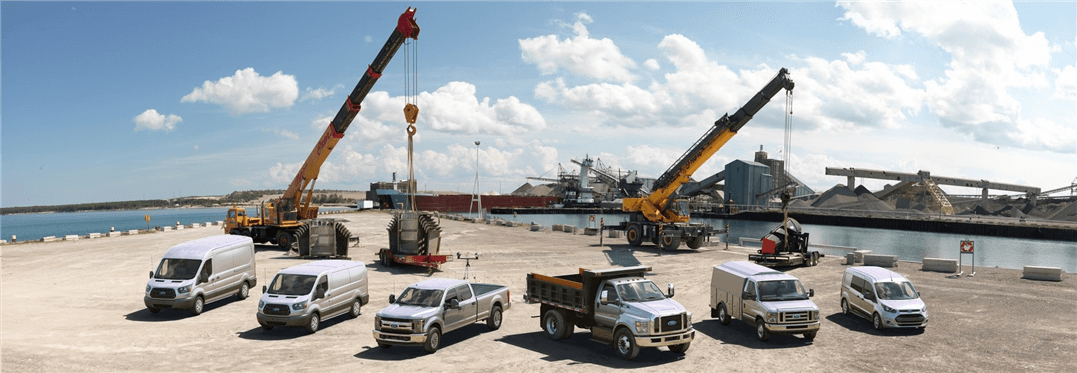

If you’re considering buying Ford commercial vehicles – including work trucks or vans – you should investigate how accelerated depreciation available through IRS Section 179 can benefit you.

What is IRS Section 179?

IRS Section 179 is a section of the U.S. tax code that provides a write-off for specified equipment purchases – including vehicles. Its main feature is that it lets small and mid-sized businesses deduct the full purchase price of equipment as soon as it is put into service. The benefit is that, at tax time, companies can deduct the equipment as a current expense rather than having to depreciate it, which puts them in a stronger financial position. Purchases and in-service dates must be completed by Dec. 31 to qualify for the appropriate tax year.

Vehicle purchases are one of the most popular uses of Section 179. Here are some important points to consider when planning to buy a work truck or van:

What vehicles are covered by Section 179?

Part of the Small Business Jobs Act of 2010, Section 179 is a federal incentive for small and midsize businesses. It applies to a variety of business necessities, including software, computers and office furniture. More importantly, it includes work vehicles that meet certain criteria, including:

- Pickups and vans that are used for business more than 50% of the time and exceed 6,000 pounds gross vehicle weight. These vehicles may qualify for at least a partial Section 179 deduction, plus bonus depreciation.

- Vehicles that are obviously for work and cannot double as personal vehicles, such as forklifts or trailers, or those that seat more than nine passengers behind the driver’s seat such as hotel or airport shuttle vans.

- Delivery-type vehicles, such as cargo vans or box trucks with no passenger seating.

- Specialty work vehicles such as hearses or ambulances.

Ford vehicles that qualify for Section 179

- F-250 Super Duty truck

- F-350 Super Duty truck

- F-450 Super Duty truck

- F-550 Super Duty truck

- F-650 Medium Duty heavy truck

- F-750 Medium Duty heavy truck

- E-350 work van

- Transit work van

All these vehicles have the required manufacturer’s gross vehicle weight rating (GVWR) of at least 6,000 pounds. To verify the rating, check the label on the inside edge of the driver’s side door near where the hinges meet the frame of the vehicle.

You can browse our inventory of work trucks and vans, or contact our commercial vehicles team for additional information.

What is the allowance for commercial vehicle depreciation?

Section 179 has specific dollar limits on how much you can deduct. For 2021, the deduction limit is $1,050,000 with an equipment spending cap of $2,620,000. Both new and new-to-you commercial vehicles qualify for the deduction. Under Section 179, companies can write off the purchase price of any qualified equipment – including vehicles – up to the deduction limit.

Some purchases have their own dollar caps. Heavy vehicles, for instance, have a limit of $25,000 per individual item. Say you financed a 2021 F-250 Super Duty for $45,000 and use it for business 100% of the time. Section 179 would allow you to deduct the $25,000 and also take a first-year depreciation of $10,000 (that is, half of the remaining purchase price after the deduction).

The result is a lower tax burden and significant savings. With a $35,000 write-off, the actual cash savings is $7,350 ($35,000 x 21% corporate tax), bringing the price of the $45,000 truck down to an effective cost of $37,650.

Consult the Mullinax Ford of West Palm Beach commercial vehicles team for more detailed information.

Example Summary:

| Purchase Price | $45,000 |

| Section 179 Deduction | $25,000 |

| First Year Depreciation | $10,000 |

| Total Write-off | $35,000 |

| Corporate Tax Rate | 21% |

| Cash Savings | $7,350 |

| Effective Vehicle Cost | $37,650 |

Additional questions about using IRS Section 179

What is accelerated depreciation?

Both Section 179 and bonus depreciation (or bonus deduction) are the two most common forms of accelerated deduction. Both allow businesses to deduct more of the cost of an asset early on, rather than depreciating it over a longer period of time.

What is “bonus depreciation”?

The IRS 100% bonus depreciation allows businesses to save more on assets when they are first purchased, and can be used with or without Section 179.

What’s the difference between Section 179 and bonus depreciation?

Under Section 179, businesses can deduct a set amount of the cost of new business assets, giving purchasers more flexibility on when they take the deduction. Bonus depreciation lets them deduct a percentage of the cost and can apply to more spending per year.

Businesses can take Section 179 and bonus deductions in the same year for the same assets.

How do you take advantage of the Section 179 deduction?

The deduction is not automatic. You have to elect to take it, which means filling out Part 1 of IRS form 4562.

Ask us about IRS Section 179 for work vehicles

If you and your CPA or tax professional determine that IRS Section 179 is the right move for you, you can start shopping for the new or used Ford you need. Search our inventory now to find work trucks, work vans or other commercial vehicles. Or contact Mullinax Ford of West Palm Beach and speak with one of our commercial account managers. We can help you find the new or used vehicles that suit your circumstances and budget and that qualify for Section 179 write-offs.

Remember that Section 179 takes effect as soon as you put the vehicle into service, so don’t wait to take full advantage of this tax-saving strategy.